We recently discussed why high-impact CX needs high-impact measurement and, more specifically, measuring customer effort. This post focuses on measuring customer sentiment with organic customer feedback.

Why Measure Customer Sentiment?

Just kidding. I’ll bet this is the least controversial statement you’ll read all day — CX teams care about customer sentiment.

We’ve all seen the countless stats. In fact, many CX teams are so focused on customer sentiment that metrics like Net Promoter Score (“NPS”) and Customer Satisfaction (“CSAT”) have morphed into micro business outcomes unto themselves. Of course, every team wants to report high sentiment marks internally and externally. There’s no question that high NPS and CSAT scores are worthy goals, but alone, they won’t necessarily help you achieve macro business outcomes like reduced churn, cost of service, and increased revenue across customer relationships.

Why do we measure anything anyways? So we can improve it! If you don’t know what’s driving sentiment, you can’t improve it.

Once you know what’s driving customer sentiment, you can test hypotheses about how you can improve it. Then, you can attribute your actions to the macro business outcomes you’re after.

If your sentiment metrics aren’t consistent and context-rich enough to tell you what’s driving sentiment across your customer base, then you’re surveying customer sentiment, not measuring it.

Surveying≠ Measuring Customer Sentiment

Popular ways to understand customer sentiment include NPS and CSAT surveys. NPS surveys paint a picture of customer sentiment with broad strokes, typically asking customers how likely they are to recommend the company to others. Most companies distribute NPS surveys to various stakeholders at prescribed points along the customer journey, such as following onboarding. CSAT surveys reflect customer sentiment by asking customers to rate satisfaction across individual transactions, such as following Support interactions where customers raise issues or after customers complete a purchase. Both NPS and CSAT surveys capture snapshots in time.

Surveys like NPS and CSAT can indeed help indicate important fluctuations in customer sentiment, but not what’s driving sentiment. Without extensive supporting analysis of the underlying customer journeys, these metrics don’t clearly articulate why changes are unfolding in your customer relationships.

And their simplicity can be a double-edged sword. In a study of millions of interactions where companies asked for a CSAT rating, we found that bad CSAT ratings only captured 30% of the total risks customers expressed organically. Most CX teams have a process for reviewing interactions with bad CSAT ratings. But because good CSAT is often a goal unto itself, interactions with good CSAT ratings are celebrated at face value. While strong agent performance is indeed a cause for celebration, providing a satisfactory response to an issue doesn’t mean that there isn’t an unchecked bug still in-flight.

Worse, risks that customers express organically routinely fly under the radar when customers don’t respond to surveys — this means that CX teams don’t know what’s causing the other 70% of risks. These same risks inevitably show up later in post-mortems and survey comments, but by then, it’s too late.

Death by a Thousand Cuts

Even when used together, NPS and CSAT surveys fail to paint a high-resolution picture of your customer experience. They leave CX teams at risk of death by a thousand cuts, a principle in psychology whereby negative changes unfold in many unnoticed increments that don’t raise flags individually.

Imagine you’re a scientist working to save hardwood tree species from extinction. The trees look strong and healthy. But on the inside, their wood is succumbing to heart rot and decaying into powder. Because heart rot does its damage inside the trees, it’s likely that, on the surface, you wouldn’t notice anything different until the disease has ravaged entire plants. Once you see mushrooms growing on the outside of the trees, it’s likely that they’re too far gone to save, and it’s time to cut them down.

The risks that customers express organically and that surveys don’t capture are the thousand cuts eating away at your customer relationships.

Why do these increments of valuable organic customer feedback go unnoticed?

Because survey metrics reflect what’s already happened, not what’s happening now. In other words, relying on these metrics alone means you’ve forfeited your chance to get ahead of customer expectations. If your goal is to improve customer sentiment, you need leading indicators describing the impact of various themes in your customer experience to know what to focus on.

Limiting your sentiment measurement to surface-level metrics like surveys means you can’t see your customers’ equivalent of heart rot and have no chance to fix it before your customers seek greener pastures. Once you’re seeing less-than-stellar survey results, your customer relationships are too far gone.

Being late to the party also limits your ability to test hypotheses about how you can improve. By then, your choices might be a reactive, resource-intensive all-out effort or accepting the strong possibility of churn events.

And if what’s happening under the surface is what’s driving outcomes like customer churn and expansion, then why are we looking only at what’s happening on the surface to help us achieve the outcomes we want to encourage and avoid?

Measuring vs. surveying customer sentiment means you can explain what’s changing, for whom, when, and why. It means you can get ahead of customer expectations to drive better micro-outcomes, like NPS and CSAT scores, and macro-outcomes, like reduced cost of service and increased revenue from customer relationships.

From a Thousand Cuts to a Thousand Opportunities

How will you identify and anticipate the thousand cuts, and turn them into opportunities, if you’re only asking a handful of questions a handful of times? The answer isn’t asking more questions — it’s actively listening to your customers’ organic feedback.

CX teams need early, frequent, nuanced sentiment analysisgrounded in organic feedback to measure customer sentiment and tie it to business outcomes. Once you have high-quality sentiment measurement, the focus shifts from “ what could we have done? ” to “ what can we do? ”

Fortunately, there are ways of understanding tree health before heart rot takes over, like tracking the presence of related fungi in nearby soil. CX teams, too, can measure all organic customer feedback for the strongest read on customer sentiment. Analyzing organic feedback with Natural Language Understanding (“NLU”) technology is how you identify what’s driving sentiment and why for all of your customers, not just those who answered a survey with detailed comments. When you measure sentiment across organic customer feedback, your thousand cuts become actionable opportunities to improve CX.

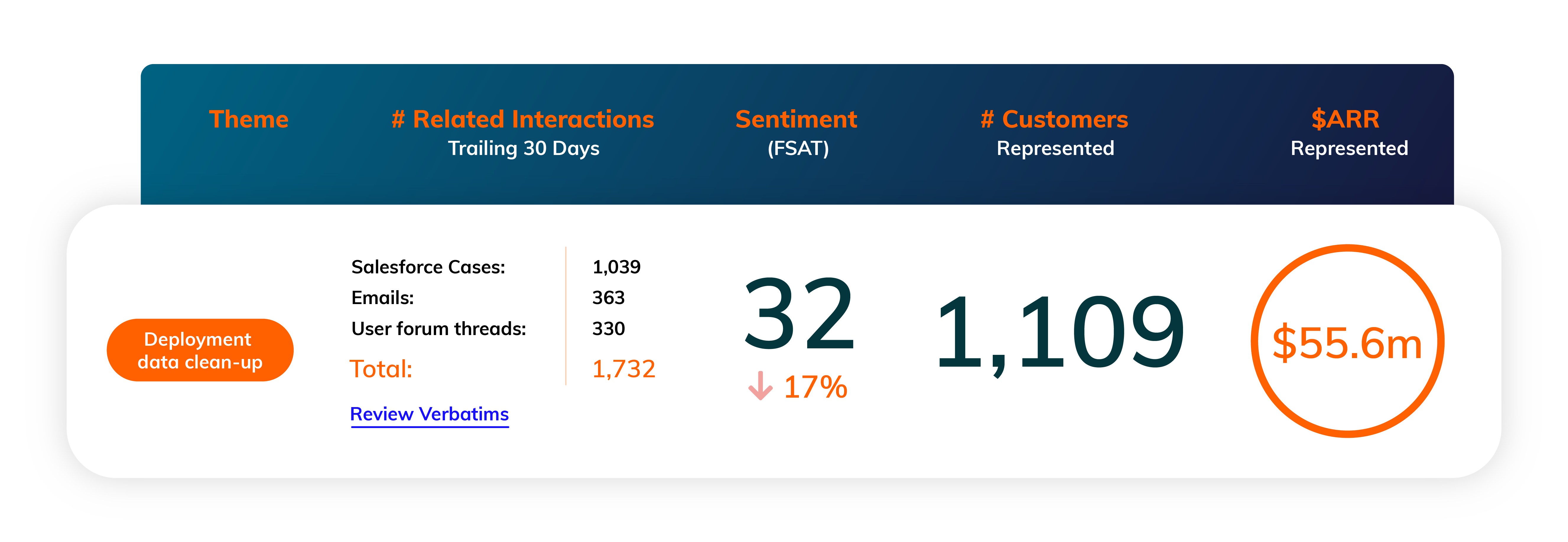

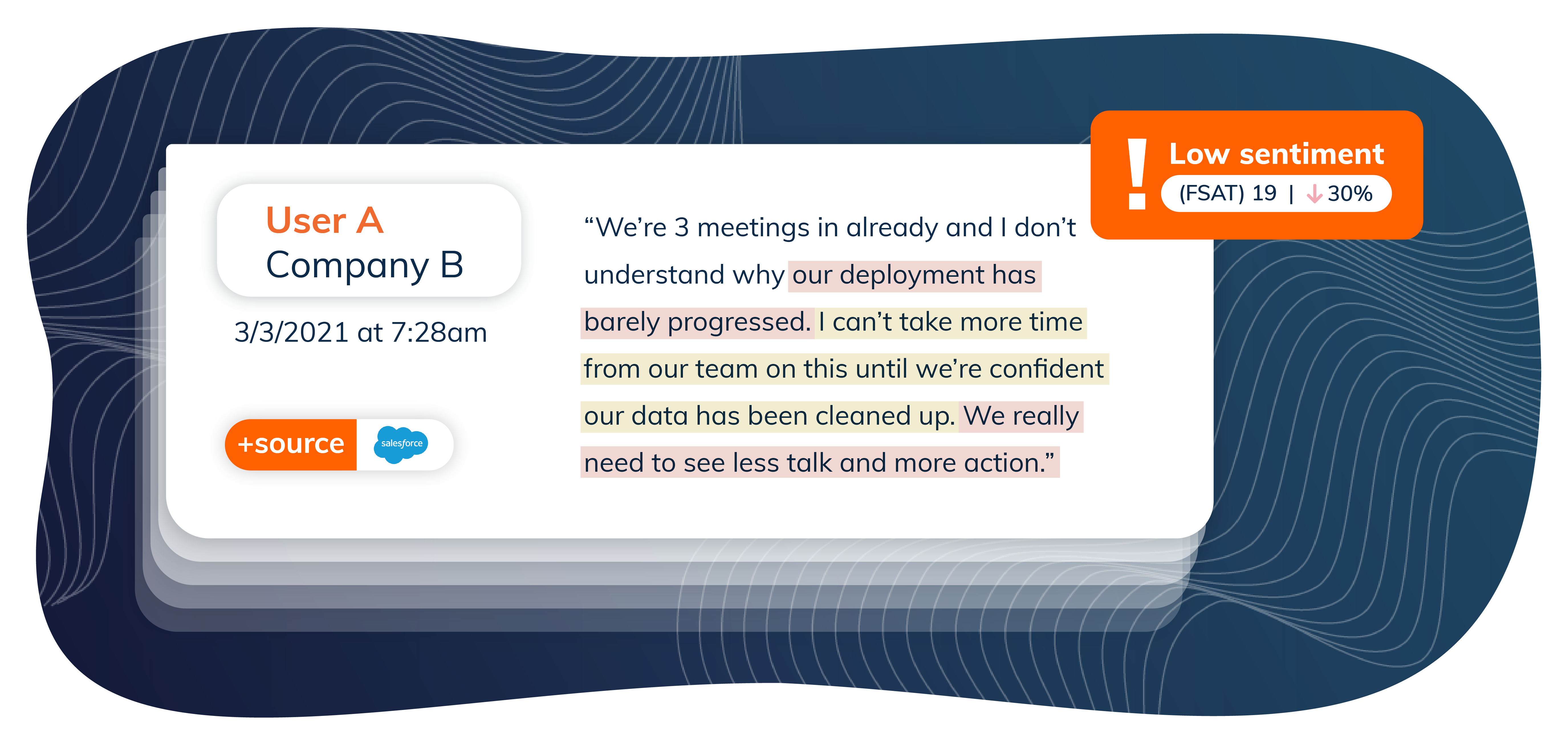

Imagine you work for a Customer Data Platform. Analyzing your organic customer feedback from channels like support, email, and user forums could reveal that customers are dissatisfied with your standard deployment offering. There are currently over 1,000 customers who are frustrated with deployment-related data clean-up issues. You review the underlying verbatims to make sure you’re evaluating the problem with the right context.

Your takeaway: Your standard deployment process asks customers for too much of their time too early on. As a result, they have heightened expectations about what they should see from your platform at this stage. The benefits of your platform are much clearer once customers have clean data. So customers de-prioritize deployment and throw their hands up,reverting to their manual process for merging records.

In summary, you’ve discovered leading indicators of customer sentiment using organic customer feedback. You’ve identified a specific cause of negative sentiment that threatens a business outcome both you and your customers care about —successful deployment.

Using a feedback intelligence tool, you can surface several examples of this negative sentiment unfolding in context, quantify the impact, and set goals to improve sentiment during deployment.

Since you know what’s behind your negative customer sentiment, you can test hypotheses about how to improve. For example, you might limit the number of customer meetings before the data clean-up is complete or even launch self-serve capabilities to enable customers to get started on cleaning up their own data. Let’s say you try both.

How do you know it worked? You should see a reduction in the number of customer mentions of deployment-related data clean-up issues and an increase in sentiment when it does come up. It should become less of a hot-button issue when customers are confident that you are on top of it, even if you’re not there yet. You should see an increase in NPS following deployment.And finally, you should see customers who are eager to grow with you, ultimately evidenced by lower churn and higher expansion rates.

Had you just waited for the post-deployment NPS survey, you might hear from a few customers about what frustrated them. But by then, customers might be back in a comfortable groove with their tried and true process that doesn’t include you. How would you have known to prioritize the actions you took if you couldn’t reliably assess how many customers felt this way?

Every positive customer interaction and successfully solved problem build toward more mutually beneficial customer relationships. Measuring organic customer feedback helps you use every single win as a building block toward those better customer relationships. Organic customer feedback is the key to distinguishing routine issues from severe problems, nice-to-have vs. mission-critical, and most importantly, driving better business outcomes, from better survey ratings to better margins on your customer relationships.

For more on our approach to measuring customer sentiment, check out our infographic with 5 Benefits of the AI-Driven Organic Promoter Score.